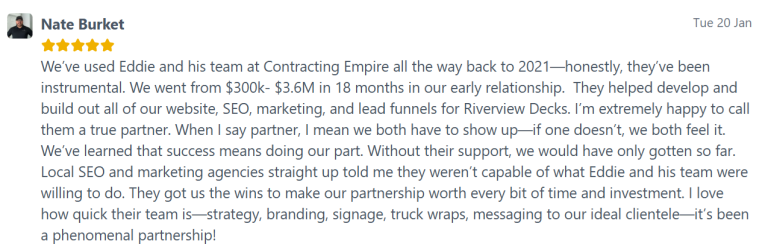

Case Study: From "One-Man Show" To $3.6M In Revenue In Just 18 Months

Riverview Decks, deck building company in Knoxville, TN

In mid-2022, Nate Burket was a prisoner of his own business.

He was running a remodeling company, wearing every hat, and grinding through jobs that didn’t excite him just to keep the lights on. Like most contractors, he was dealing with:

- Tight finances that left no room for error.

- Wearing all the hats, which meant he was always working and never leading.

- Zero freedom. If he wasn’t on the job site, the money stopped.

Nate talks about his initial goals and current situation after just 18 months

Like most contractors, Nate believed good work would eventually compound. But good work doesn’t create leverage. Visibility and positioning do.

The Decision to Play a Different Game

Nate wanted financial freedom but remodeling was a dead end. You can’t build an empire when you’re spread too thin across five different remodeling niches.

Our market analysis showed something simple: Knoxville didn’t need another general remodeler. It had a wide-open gap for a premium deck-only brand. So we suggested a total identity shift.

To build a $1,000,000 lead engine from scratch and bring Nate to his financial goal, the buy-in was 7%: a $70,000 investment in marketing.

Most contractors see $70k and see a “bill” they can’t afford. Nate saw it for what it was: the price of admission to a different league.

But the $3.6M didn’t happen by accident. It required dismantling the four biggest traps holding Nate back. We tackle these four major turning points below, so keep reading!

The 18-Month Explosion From $0 to $3.6M

The result was total market takeover.

In just 18 months, Riverview Decks went from a brand-new domain with zero authority to $3.6M in revenue.

Because the engine we built started doing the heavy lifting, that initial 7% investment dropped to a measly 2.5% of his total revenue. The marketing didn’t just pay for itself; it became one of the most profitable moves Nate ever made.

Nate and his new Corvette

Turning Point #1: The "Cheap Website" Trap

Because this was a completely new business, there were no online assets for Riverview Decks. Nate didn’t even have a brand, let alone a Google Business Profile or any digital footprint of any king.

Nate was starting from a clean slate… and this is where most contractors make their first expensive mistake.

They treat the website as a one-time asset, not a core operating system. They buy a $3,000 “brochure” site, feel responsible for saving money, and move on.

The problem isn’t that these sites look bad. It’s that they don’t do anything.

Here’s what “cheap” websites actually cost:

- They don’t pre-sell the job. Every prospect shows up cold. Price resistance stays high. Sales effort stays manual.

- They don’t evolve. No tracking. No testing. No improvements based on real user behavior. Whatever problems exist on day one stay there forever.

- They create repeat work you don’t see. In 12–18 months, you’re rebuilding the site, redoing the messaging, and fixing decisions that should’ve been solved once.

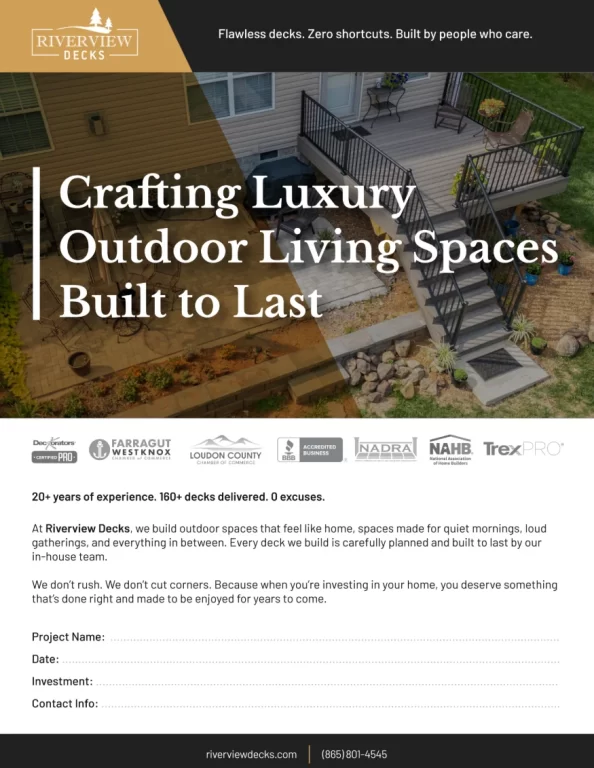

Instead of buying a website, Nate invested in a living system.

A site that:

- Clearly differentiated Riverview Decks from every local competitor

- Guided prospects through a predefined decision path before reaching out

- Built trust and authority before homeowners even got on a call

- Tracked user behavior and improved over time

- Evolved alongside the business without constant involvement on his part

From an operator’s perspective, this mattered more than rankings or design. It removed a constraint.

Nate didn’t have to manage updates. He didn’t have to rethink his site every year. He didn’t have to worry about future rebuild costs.

The website stopped being a question mark and became infrastructure.

And once that foundation was in place, everything else could compound on top of it.

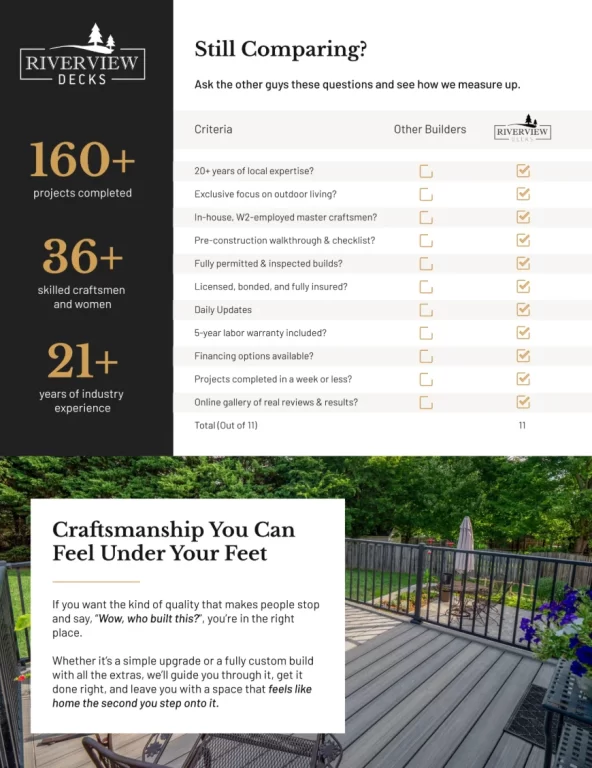

Turning Point #2: From Anonymity to "The Only Logical Option"

At a certain level, branding stops being about looking good. It becomes a filter.

Before Riverview Decks had a real brand, Nate’s work quality did the selling after the call.

That meant:

- explaining value on every estimate

- justifying price repeatedly

- competing against “some guy with a truck”

The biggest lie in contracting is that good work sells itself. Good work only matters after someone decides to call you. Until then, you’re just another option in a crowded list.

So the goal wasn’t “better marketing.” It was decision control.

Riverview Decks Facebook Ads – Made by Contracting Empire

Think of the world’s biggest brands and the identities they sell:

- Nike sells victory.

- Rolex sells status.

- Apple sells simplicity.

- And Riverview Decks sells outdoor freedom.

By positioning Riverview Decks as the only logical choice for high-end outdoor living, the brand stopped competing on price and started winning on authority.

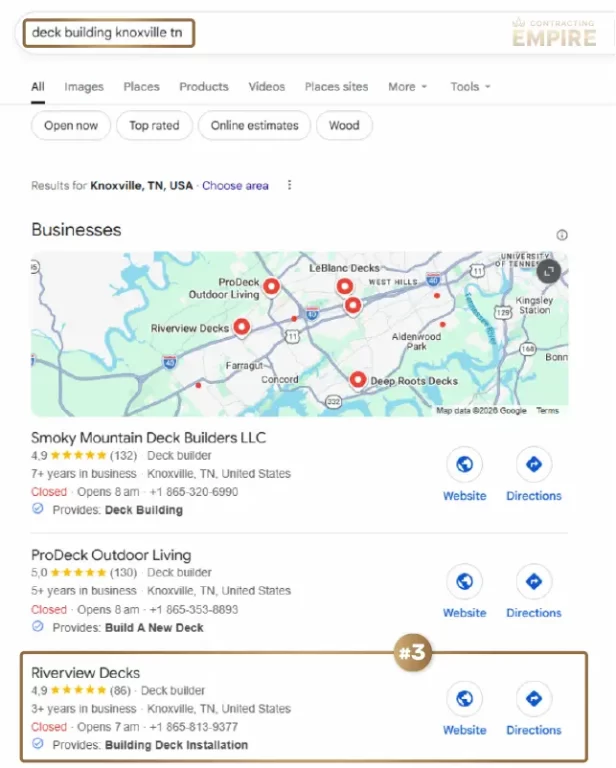

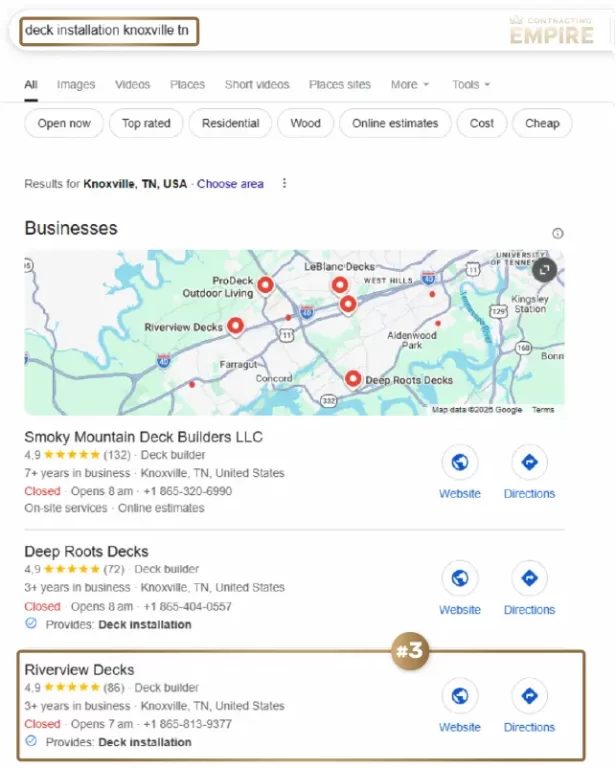

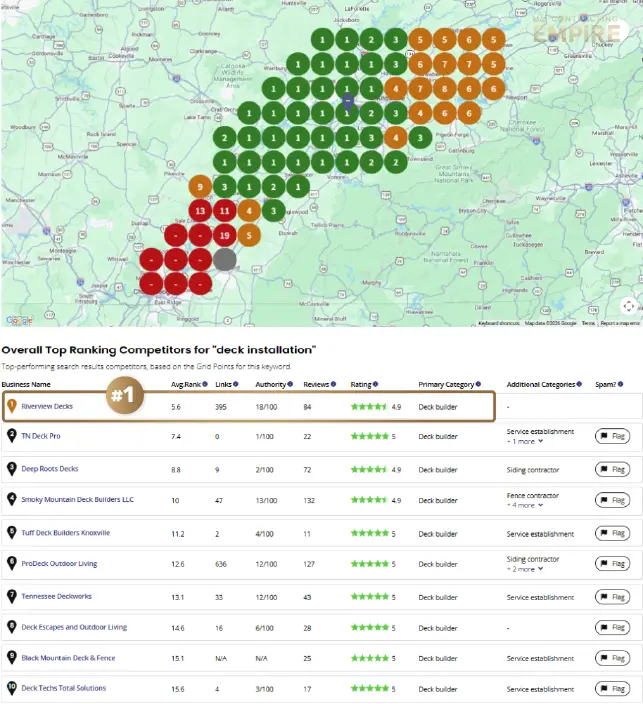

Turning Point #3: Local Search Domination with SEO, Local SEO, AI SEO

Every deck building project starts with a person’s intent.

When a homeowner decides it’s time to replace or build a deck, they search. That moment is short, high-intent, and unforgiving. If you’re not visible where homeowners search, you don’t exist.

Once the foundation and positioning were in place, the next objective was simple:

show up every time intent appeared.

Across Google search, map results, and AI-driven recommendations, Riverview Decks became the repeated answer at the exact moment a buying decision was made.

Homeowners stopped calling three contractors “to get quotes.” They called Riverview to check availability.

We achieved this through a “scorched earth” approach to local search:

- The #1 Spot: We secured the #1 organic position for high-intent terms like "deck replacement Knoxville TN".

- AI-Search Authority: Riverview became the #1 recommendation across ChatGPT, Perplexity, and Grok AI. Even if homeowners changed their search behaviour, Riverview Decks is everywhere in the top results.

- 24/7 AI Lead Handling: We implemented "Jessica," an AI voice and chat agent trained on Nate’s specific brand data to answer calls and book appointments after hours.

From an operator’s standpoint, this mattered for one reason: demand stopped being random and relying on the weather outside. Instead of chasing work, Riverview controlled when and how work entered the business.

Turning Point #4: Total Visibility and Decision Control

As we ramped up the lead volume for Riverview Decks, we moved into the most critical phase: Operational Intelligence.

High lead volume is a win, but it creates a new level of complexity. When you’re juggling multiple channels, various job sizes, and different close rates, “gut feel” becomes a liability. We knew that to scale Nate’s spend safely, we couldn’t rely on surface-level metrics or the “vague sense” that things were working.

Most agencies just hand over a report of “clicks” and “impressions” and call it a day. We don’t play that game.

We saw the opportunity to tighten the ship, so we installed a custom attribution and ads dashboard to give Nate total command over his numbers.

With this level of visibility, the “gamble” of advertising was gone. We turned his marketing into a predictable, controllable input. Growth was no longer limited by the leads we could generate, it was only limited by how many crews Nate wanted to put on the road.

Amateur Guesswork vs. Pro-Level Intelligence

Growth isn’t just about lead volume; it’s about the quality of the decisions you make with those leads. Without a clear line of sight on attribution, even the best business owners are forced to ask “blind” questions. You can’t make high-level moves when you’re only looking at surface-level data.

By installing a real-time tracking suite, we shifted the entire focus of the operation. We moved away from wondering “if” things were working and started dialing in the exact ROI of every dollar spent.

This table breaks down the shift from the typical “blind” questions to the high-leverage questions that actually drive a business forward:

| Wrong Questions (Without Data Attribution) | Right Questions (With Data Attribution) |

|---|---|

| Is this working? | What’s our cost per booked job and cost per acquired customer by channel? |

| Facebook says we got leads. Why didn’t revenue jump? | How many leads turned into real appointments, and how many of those turned into signed jobs? |

| Should we pause ads this month? | What’s our break-even cost per lead based on close rate and average job size? |

| Leads dropped. Did something break? | Is this seasonal behavior, a tracking issue, or a real demand shift? |

| What should we change? | Where is the bottleneck: reach, click-through, landing page, speed-to-lead, or sales follow-up? |

| Are clicks up? | Are booked calls up, show rate stable, close rate holding, and margins protected? |

| Is the agency doing their job? | Which levers are we pulling this month, what result should they produce, and how will we measure it? |

| Where are these leads even coming from? | Which channels are creating demand and which are capturing existing demand? |

| What did we get this week? | What do the 30/60/90-day trends show, and what indicators move before revenue? |

| If we spend more, will this stop working? | At what spend does cost rise, why does it rise, and how do we scale without breaking efficiency? |

| These leads suck. Is it the ads? | Is lead quality breaking at targeting, offer, landing page, or sales follow-up? |

| So… what now? | Based on the data, do we hold, scale, reallocate spend, or fix a bottleneck next month? |

The Riverview Decks Success Timeline

2022

The Foundation & "Digital Word-of-Mouth"

- May 2022: Nate officially joins the Empire.

- June 2022: We launch Nate's first high-end website.

- August 2022: Google Ads campaigns go live

- November 2022: The brand moves "off the screen" and onto the streets. We design high-impact vehicle wraps for his F-150 service trucks

2023

Solidifying the Brand

- January 2023: Organic traffic hits a major milestone, reaching 100 clicks per week.

- May 2023: A massive mindset shift toward safety-led marketing. The team launches an emotional Deck Safety Month campaign.

- June 2023: Nate sells a $127,000 deck project to a high-profile executive, proving the brand is attracting "A-Player" clients.

- August 2023: Nate signs a lease for a physical office HQ to build company culture and exit his home office.

2024

Scaling Systems & Speed

- February 2024: Introduction of the "3-Day Deck" concept. This streamlines operations and creates a unique "Fast Pass" offer in the Knoxville market.

- May 2024: Nate reports that between January and May, he has reached a point where he is essentially "getting paid $8,390 per appointment" based on his closing data.

- September 2024: Nate moves to a Double Lifetime Warranty, a "bold claim" that officially separates him from every other local competitor.

2025

Nashville Expansion & AI

- January 2025: Research begins for Nashville expansion.

- February 2025: Organic #1 Spot: Riverview Decks officially hits the #1 position in Google organic results for "deck replacement knoxville tn".

- July 2025: Launch of the AI Voice & Chat Agent. Nate’s business now has a 24/7 AI agent trained on his specific data to answer calls and book appointments after hours.

- August 2025: A single "Back to School" Facebook campaign generates $188,682 in sales from just a $1,200 ad spend.

2026

Market Dominance

- January 2026: Nate sets a $7M revenue goal and expands his team to 5 active selling consultants.

- February 2026: Riverview Decks is now a top-cited authority in AI Search (ChatGPT, Perplexity, Grok).

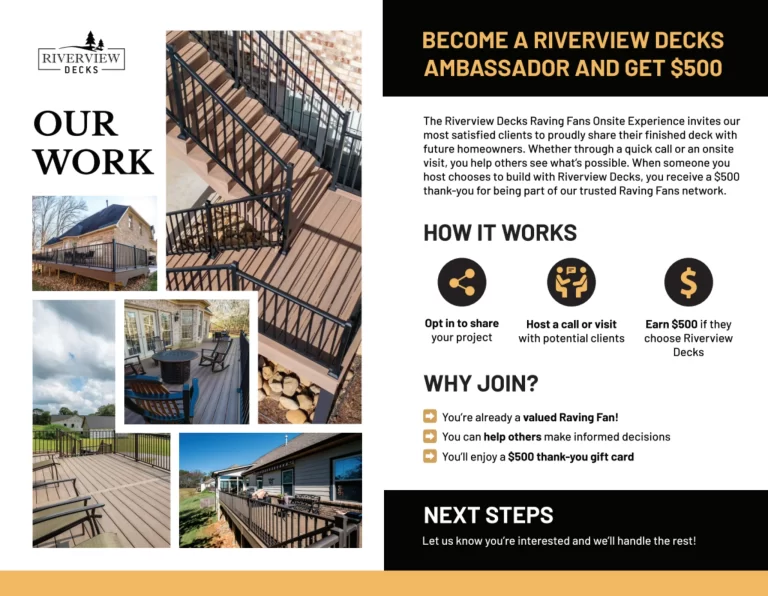

Key Takeaways

Nate’s story isn’t just about getting more deck leads. It’s about a complete transformation of how a construction business functions.

By moving away from “gut feel” and installing a system built on real-time data and aggressive attribution, the results moved beyond just a healthy bank account:

- Nate’s business continues to grow in revenue.

- He has officially signed a lease and opened a new office headquarters to build company culture and communicate more effectively.

- He is now actively taking market share in Chattanooga and has a clear rollout plan for Nashville.

- He built a solid mindset by fixing the many business problems that came up.

- Grew the team, has more people on site, doesn't have to work in the business.

- Nate went from a prisoner of a remodeling company to a CEO who manages 5 consultants while driving his dream Corvette.

Take Control Over your Lead Sources, Intake & Ad Spend

If you’re ready to scale with the same level of precision we built for Riverview Decks, let’s talk.

Similar Case studies

We enabled a closet installer in Washington State to outrank million-dollar franchises and close more sales than ever.

We drove over $1.25 million in earnings for a remodeling company in Nevada after an investment of just $27k.

We helped an Omaha deck-building company scale faster and add over $2M in revenue yearly.